How to Improve Cash Flow Without Cutting Costs

Get our latest news and updates.

What is your first instinct when business cash flow tightens?

If you thought cutting costs is the answer, you’re right. It is usually the first option for business owners when they’re in a cash crunch.

But cost-cutting to save money is not always the smartest move, especially if it’s the first move you make when cash is tight. In many cases, there’s more to gain by improving how cash flows through your business, without cutting into resources, staff or operations.

Let’s break down some simple ways you can unlock more working capital, speed up receivables and manage outgoings more effectively.

1. Stay on top of late payments

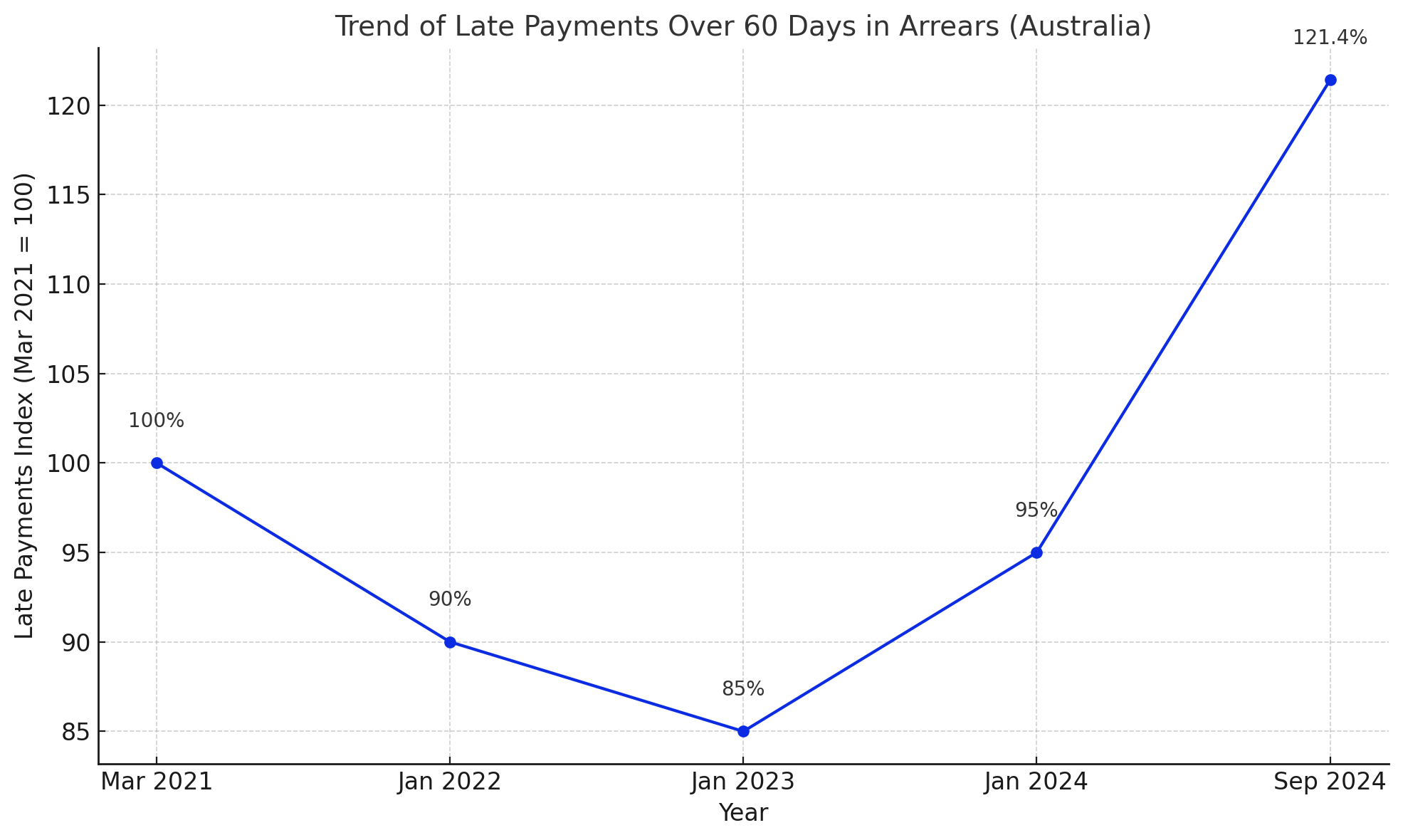

Late payments remain one of the biggest causes of cash flow issues for Australian businesses. As of September 2024, the rate of B2B payments that are over 60 days in arrears has jumped by 21.4%, hitting the highest level since March 2021.

The rise in late payments isn’t random. Many Australian businesses have been under increasing financial pressure, especially small businesses in sectors like construction and hospitality. With operating costs climbing, interest rates higher, and cash reserves stretched, it’s becoming more common for businesses to delay payments to manage their own cash flow.

This kind of pressure creates a ripple effect through supply chains, making it even more important to have a clear strategy in place for chasing receivables and protecting your own cash position.

Late payments impact your ability to pay suppliers, staff and other operating costs, so it’s critical to stay proactive.

Review your payment terms, follow up on overdue invoices promptly, and consider offering incentives for early payment. A cloud-based invoicing system or even using outsourced CFO services can also make this process more efficient and consistent for your business.

The simplest changes can make a significant difference to a company’s cash flow. For example, invoicing immediately after the work is done with automated reminders for clients to pay will help improve the consistency of cash flow. Tools like Stripe, GoCardless or Xero-integrated payment gateways make it easier for clients to pay quickly.

You could even incentivise early payment or consider upfront deposits for large jobs.

2. Revisit your pricing strategy

Your pricing has a direct impact on your cash position. If you’re priced too low, you’re leaving revenue on the table. If your pricing is too complex, your clients take longer to say yes and sign on the dotted line, creating a longer sales cycle.

A fractional CFO can help you model pricing scenarios to understand the true cost-to-serve per client or product line. With those strategic financial insights from a CFO (sometimes referred to as an outsourced CFO, or virtual CFO), you can simplify pricing, improve profit margins and drive more predictable cash flow, without needing to cut costs or increase volume of work.

3. Negotiate better payment terms with suppliers

Just as you’re chasing prompt payment from clients, you can also benefit from negotiating longer terms on the payables side. Extending payment terms by even 15 days can give your business a valuable cash buffer.

You could also consider working with key suppliers to understand where there’s flexibility. If you have a strong payment history, they may be open to extending terms or offering discounts for early payment.

External CFO services can help you structure those conversations if you need more in-depth knowledge and expertise in supplier payment terms.

4. Improve inventory and stock control

For product-based businesses, excess stock ties up cash and creates storage costs. Understocking, on the other hand, can lead to missed sales. You need to balance these two things more effectively.

Using smarter inventory management systems, or tapping into fractional CFO services that analyse your inventory turnover, can help you balance stock levels based on demand cycles.

Better planning and control means better cash flow.

5. Automate as much of your financial processes as possible.

If your business is still manually issuing invoices, chasing payments, or managing payroll in spreadsheets, you’re likely creating unnecessary lags in your cash flow cycle.

Automation tools can reduce admin time and improve accuracy. If you really want to get the most out of automation, you could combine it with expert guidance from a Sydney tax accountant or financial expertise from a fractional CFO to give you real-time visibility into your numbers, so you can take action before small problems become big ones… like not having enough cash on hand in time for payroll.

6. Monitor your cash flow daily, not monthly.

Cash flow issues rarely happen overnight. They build gradually when no one’s watching. Too many businesses wait until the end of the month to check in, only to realise they’re short on cash, and it’s too late to do anything about it.

A daily cash flow check doesn’t need to mean hours buried in spreadsheets. With the right tools or support from a fractional CFO, you can track upcoming payments and expenses, spot red flags early, and take action before small gaps turn into big problems.

Cash flow forecast tools like Fathom, Float or Calxa make it easy to visualise your cash position day by day. If you’re dealing with higher transaction volume or growth activity, an external CFO service can set up a real-time dashboard that gives you the numbers you actually need, minus the manual admin.

7. Access short-term working capital with intent.

When your business is growing, launching something new, or waiting on large invoices to clear, cash flow can tighten, even when you’re doing everything right. Timing issues like these are common and don’t always signal a bigger problem.

Rather than pausing projects or dipping into personal funds, consider funding options like invoice finance, business lines of credit, or short-term overdrafts. The key is knowing what kind of capital fits your situation and planning for it early.

A strategic approach, guided by a fractional CFO accounting service, ensures you’re not just accessing capital, but doing it in a way that supports your long-term cash position, not just plugging a hole.

Build a better cash flow strategy with CFO support that fits your business.

Improving business cash flow doesn’t have to mean cutting staff or trimming every expense. With the right financial systems, pricing models, supplier terms and visibility, you can stay in control of your cash and keep your operations running smoothly. Or, take advantage of the expertise a fractional or outsourced CFO can bring to the table.

At Quantum House, we provide outsourced CFO services for small to medium businesses that want high-level financial guidance without the high cost of a full time CFO. We support business owners with practical financial leadership, financial reporting and forecasting, including payroll, compliance, and strategic planning.

Our team works closely with you to improve financial clarity, identify the key drivers of cash flow, and help you make smarter decisions faster.

If you want to understand your numbers better, take control of your cash flow and set your business up for stronger growth, let’s talk.

Contact us today for a straightforward consultation and find out how our CFOs and accounting services in Sydney can help you improve your cash flow and profitability.