What Counts as R&D Under the ATO’s Tax Incentive Rules

Get our latest news and updates.

The Australian Government’s Research & Development Tax Incentive is its largest innovation support mechanism, with 11,545 companies claiming $11.2 billion in R&D expenditure for 2021–22.

Eligibility under the AusIndustry R&D framework hinges on strict tests for core experimental work and supporting activities.

Without precise classification and audit-ready documentation, even genuine projects can fall foul of the ATO R&D Tax Incentive rules and trigger compliance reviews.

Investing in innovation can feel risky when you’re building a business. Many businesses struggle to determine exactly what qualifies as genuine R&D. Making the wrong assumption could result in issues with the ATO instead of enjoying a helpful tax offset.

Below, we cover what counts (and what doesn’t) as research and development under the Research and Development Tax Incentive rules, and why working with specialist R&D tax accountants can save your business headaches and money down the track.

Eligibility Requirements for the R&D Tax Incentive.

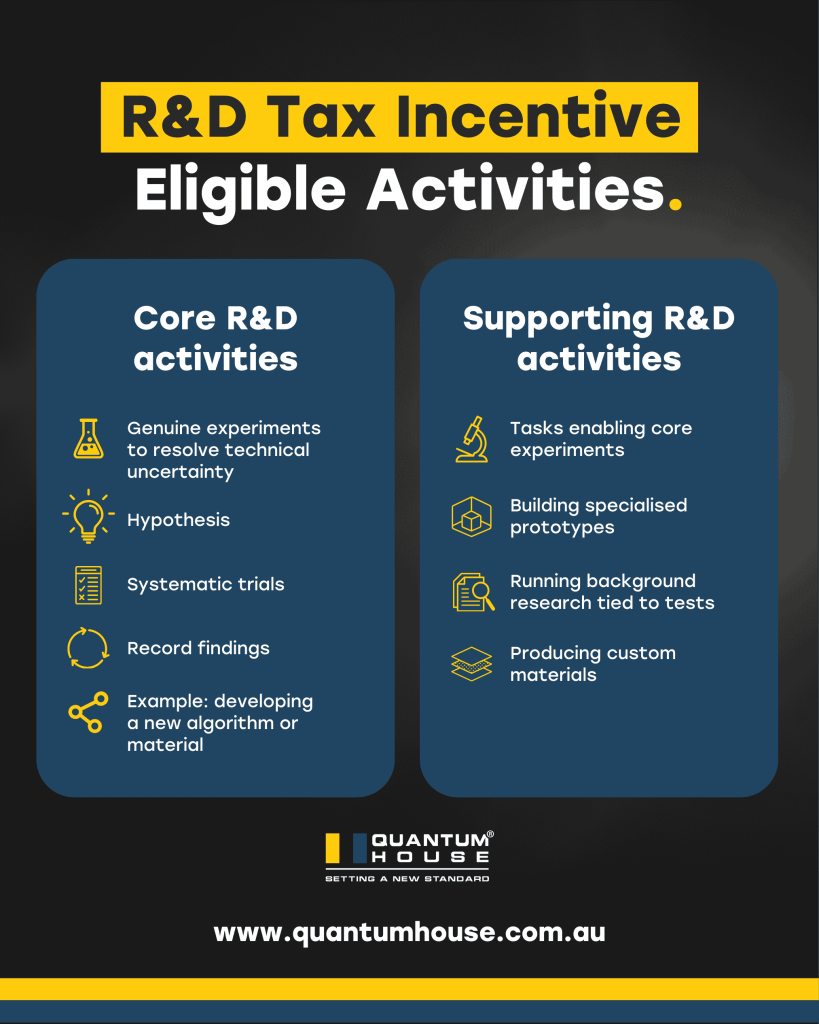

The ATO and AusIndustry split eligible work into two categories:

Core R&D and Supporting R&D.

Core R&D involves structured experiments to tackle a specific technical challenge. You start with a clear hypothesis, run methodical tests, log your results and adjust your approach as you learn. For example, creating an algorithm that outperforms existing solutions would count as core R&D.

Supporting R&D includes the work that makes those experiments possible. That could mean building specialised prototypes, doing background research tied to your tests or producing materials used only in your experiments. These activities qualify only if their main purpose is to back up your core experimental work.

Supporting R&D activities that back up your experiments.

Supporting R&D covers the prep work and follow-up tasks your core experiments rely on. Each activity must be focused on helping those experiments. For example:

- Building specialised prototypes used solely for testing

- Conducting background research that feeds directly into your experiments

- Producing materials exclusively for your R&D trials

Tasks not focused on supporting your core experiments won’t meet the ATO’s criteria.

Common misunderstandings about the ATO R&D tax incentive rules.

Many business owners believe everyday activities qualify under the R&D Tax Incentive when in fact they do not. Minor product tweaks and routine market testing lack the experimental structure the ATO requires.

Promotional campaigns and launch costs count as normal business expenses, not research and development. Likewise, upgrading your own systems or running staff training supports operations but does not involve the kind of hypothesis-driven testing that earns an R&D offset.

Expenses you can claim

You can include direct project costs such as:

- Employee wages for staff working on R&D projects

- Contractor and consultant fees for technical experimentation

- Materials and consumables used up during trials

- Depreciation on equipment dedicated to your R&D work

Mixing these with ineligible costs like marketing, rent, interest, unrelated legal fees, or building expenses risks a compliance review and possible clawback.

Keep your documentation audit ready.

Strong record-keeping sets compliant claims apart. You should capture your hypothesis, test methods and results as they happen, log staff hours and expenses against each experiment, and store all related data, prototypes and invoices together.

Clear, up-to-date files reduce audit risk and speed up your claim processing.

Why specialist R&D accountants are so important.

The Research and Development Tax Incentive demands deep expertise.

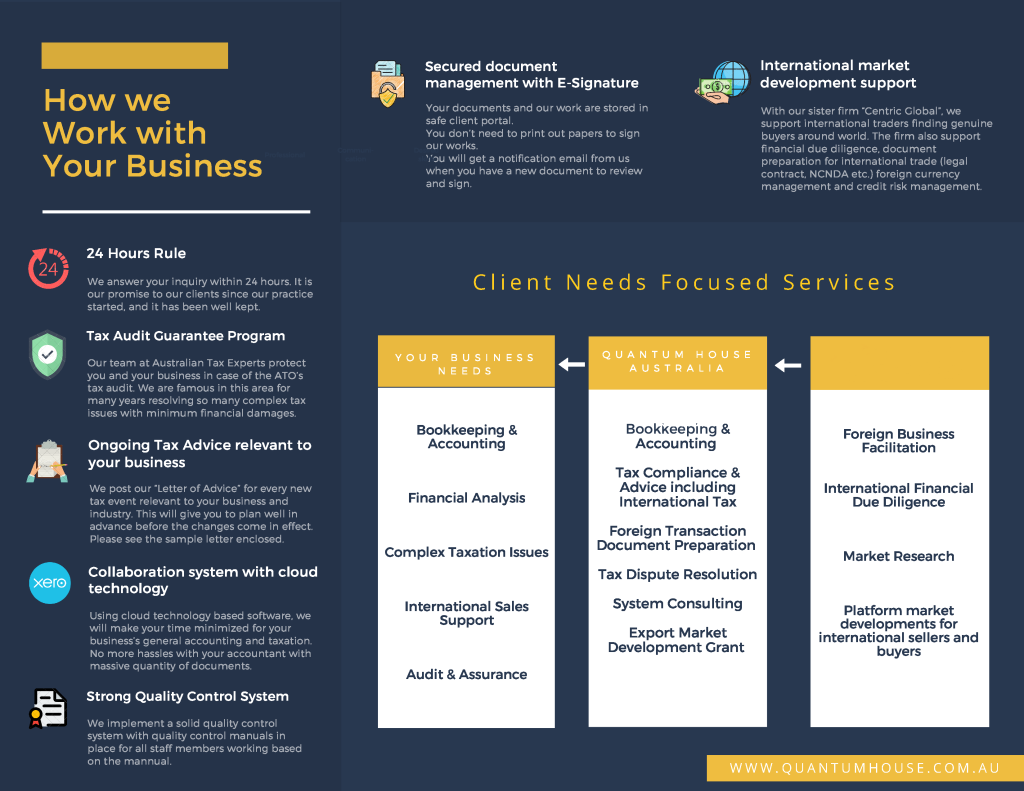

Quantum House’s team of R&D specialists and business tax accountants will register your projects with AusIndustry, align your activities to the current requirements and prepare claims built to withstand scrutiny. Our corporate tax accounting expertise ensures you unlock every dollar of support.

Secure your R&D offset and protect your innovation pipeline.

Investing in R&D fuels growth only when your claims meet ATO standards. With precise classification, correct expense claims and audit-ready documentation, you’ll make the most of the ATO R&D tax incentive.

Contact Quantum House today for practical guidance from Sydney’s leading R&D tax services and keep your innovation on track.